Family Offices Eye Cryptos as Scrutiny Tightens

Despite their volatility and lackluster performance and returns in recent years, cryptocurrencies (“cryptos”) remain an investment target among Asian family offices, while blockchain technology and related businesses are also targets as around 30% to 35% of family offices are seeking to increase their exposure to blockchain technology and 27% looking to expand cryptos investment allocation in their portfolios according to various research and surveys.

In one study, 92% of family offices and wealthy investors in Hong Kong and Singapore are interested in digital assets, with 58% already invested and 34% with plans to invest. As properties and stocks remain subdued, investors and managers are looking at alternative assets, even though cryptos in general have lost around 70% of their market value since their peak in November 2021, some believe the market has plateaued.

Blockchain investments are more like traditional business startups, less speculative in nature than cryptos, where investors are looking for blockchain-driven disruptions within traditional industries. Digital assets therefore are an increasingly important investment class for portfolio diversification.

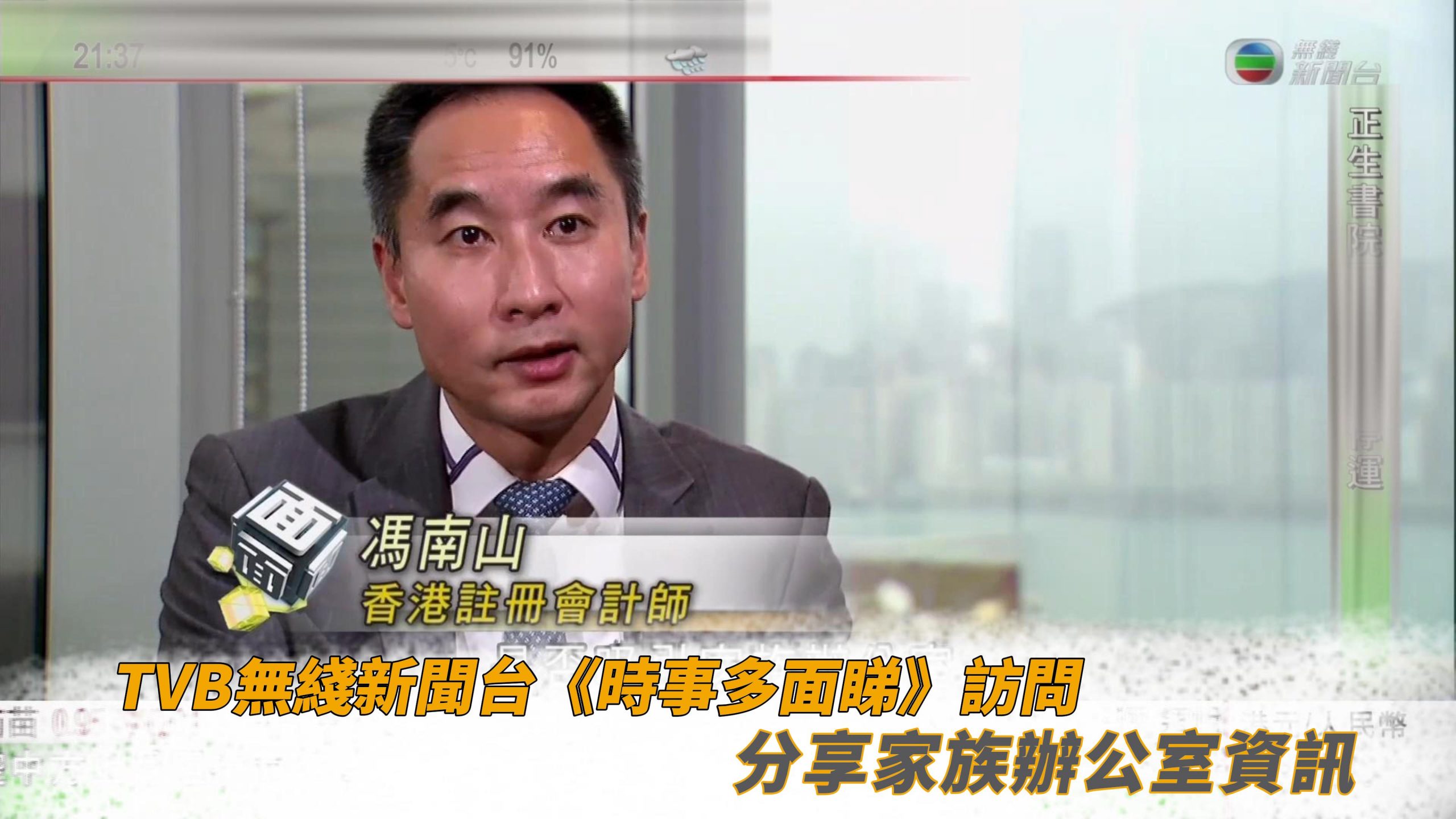

Yet this comes at a time of increased supervision and governance from governments across the world as numerous meltdowns and scandals have plagued the industry recently. The collapse of FTX has shocked regulators into action, and with exchange closures, fraud and alleged scandals closer to home in Hong Kong, local authorities have implemented a mandatory licensing regime for centralized crypto exchanges that allow them to accept retail investors. A strengthened regulatory regime seeks to position Hong Kong as a digital asset hub among strong competition from regional cities.

Last year, 17 jurisdictions including Hong Kong, the European Union, Singapore, South Korea and the United States, have tightened cryptocurrency regulations. International organizations, including the G20, the Financial Action Task Force, the Financial Stability Board, International Monetary Fund, and the International Organization of Securities Commissions, have all outlined global frameworks and policy recommendations for regulating cryptocurrencies.

In this relatively new and evolving space, governance and regulatory requirements are also evolving and will only become more stringent, and this is expected as the market develops, matures and with new products and services coming online. Such regulatory developments may encourage even more investor interest.