Blogs

Company News

CityLinkers Group Supported Po Leung Kuk Charity Walk

Recently, staff representatives from CityLinkers Group enthusiastically took part in the Po Leung Kuk Charity Walk, themed “Snoopy Chinese New Year Tour”.

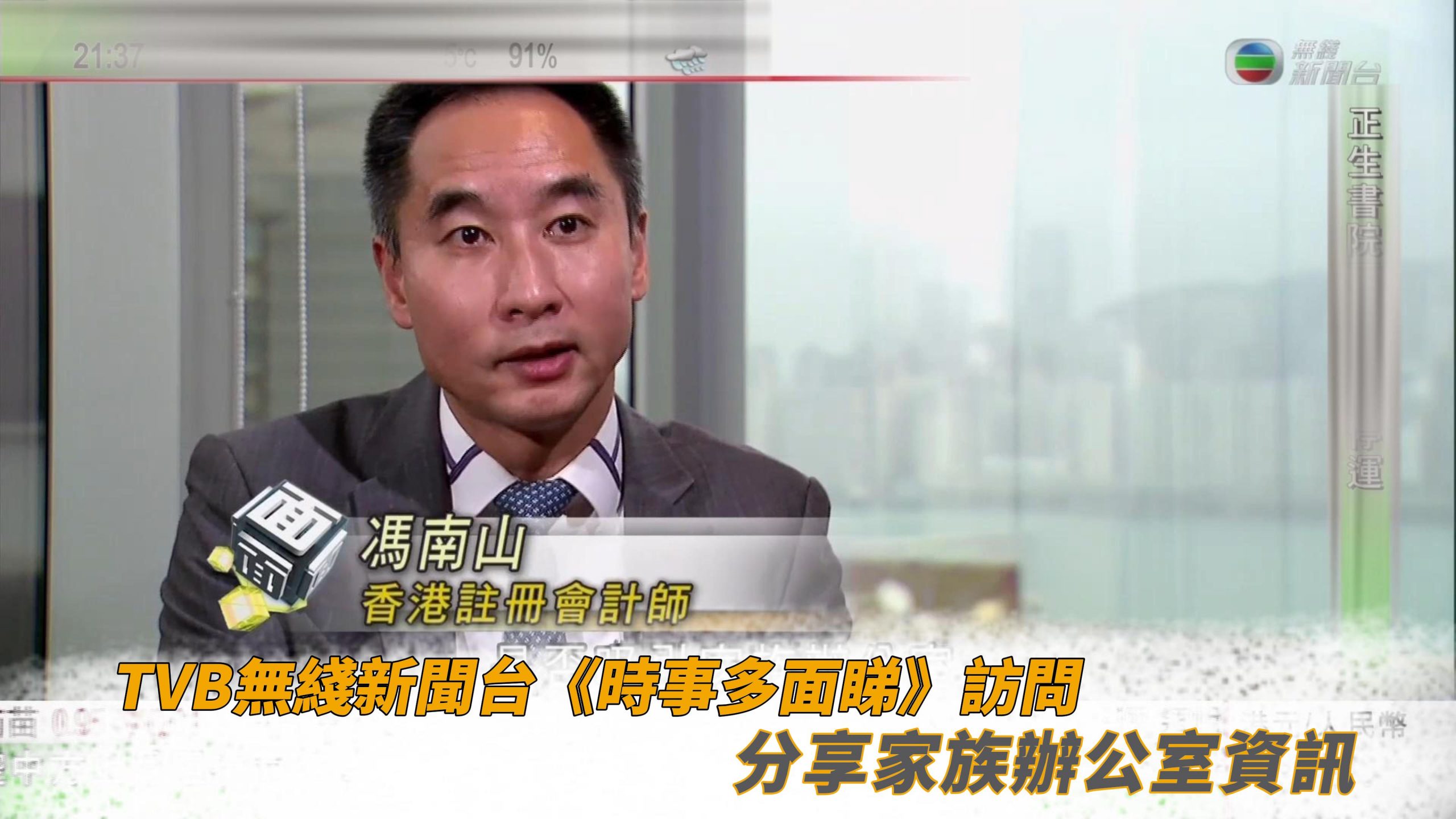

CityLinkers Shared New Trends in Wealth Management Under CRS at Ningbo Wing Family Office

Recently, Ms. Kithanie Choi, Partner and Business Director of CityLinkers Group, was invited by Ningbo Wing Family Office to attend a sharing session entitled “Looking Through CRS: New Perspectives on the Preservation, Growth, and Inheritance of Global Assets."

CityLinkers Group Received Caring Company Scheme Recognition from HKCSS

The Hong Kong Council of Social Service (HKCSS) recently held the recognition ceremony for its Caring Company Scheme and released data on charitable corporate practices, recognizing and affirming companies and organizations that have demonstrated charitable behavior.

Market News

【2026至27財政預算案懶人包】一文看清重點措施

財政司司長陳茂波2月25日發表《2026至27年度財政預算案》,主題是「創科驅動,金融賦能,多元發展,關愛惠民」,其中多項措施惠及個人及企業。

Hong Kong’s November External Merchandise Trade: Dual 18% Growth Reflects Market Momentum

The latest figures released by the Hong Kong Census and Statistics Department indicate that Hong Kong’s merchandise trade sustained robust growth in November 2025. The total export value reached HKD 468.9 billion, marking a significant year-on-year increase of 18.8%. During the same period, the import value rose to HKD 517.4 billion, also recording a year-on-year growth of 18.1%.

The Rise of Asia-Pacific Billionaires Reshapes Global Wealth Landscape

The latest UBS Billionaire Ambitions Report 2025 reveals that the total wealth of global billionaires hit a record high of USD 15.8 trillion in 2025, with their number increasing to 2,919, representing annual growth rates of 13% and 8.8%, respectively.

Our Services

Audit arrangement

Company Secretarial Services

Cloud Accounting Services and Outsource Accounting Services

Tax Services

Detail

Advisory Services

Our personable and pragmatic approach ensures strong working relationships with all our clients. We also offer a high level of access to partners and a hands-on style which results in timely, straightforward advice and insight.

Corporate Services

From entity incorporation to compliance and administrative services, we help our clients to strengthen the operational efficiency of their businesses and achieve greater value.

Fiduciary Services

Social Responsibility