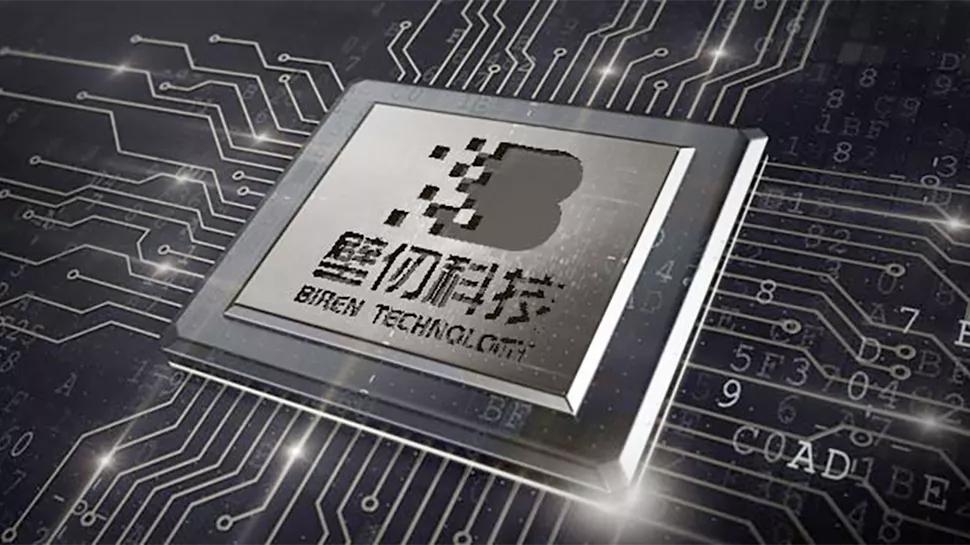

“First Mainland GPU Listed in Hong Kong,” Biren Technology IPO 2026

The offering price was set at HK$19.60 per share, with each lot comprising 200 shares. The global offering totaled 285 million shares, including over 49 million shares for the Hong Kong public offering and 235 million shares for the international offering.

Prior to its listing, Biren Technology completed multiple financing rounds, raising over RMB 9 billion in total. Key investors included Qiming Venture Partners (QM120), Country Garden Venture Capital (including Country Garden Venture Capital and Cullinan West II), Sky9 Capital, and Gree Electric Appliances Inc. of Zhuhai. Cornerstone investors include 3W Fund, Qiming Venture Partners, Ping An Life Insurance Company of China, Ltd., and other institutions, with some cornerstone investors also serving as existing shareholders of the company.

Financial Performance of Biren Technology Prior to IPO (2022 - Mid 2025)

Over the three years preceding its IPO (2022-2024), Biren Technology recorded a cumulative net loss of approximately RMB 4.756 billion, primarily attributable to sustained R&D expenditures exceeding 73% of total operating expenses.

During the same period, revenue surged from RMB 499,000 to RMB 337 million, reflecting the gradual commercialization of its intelligent computing solutions. Gross profit margin declined from 53.2% in 2024 to 31.9% in the first half of 2025, primarily influenced by shifts in product mix and customer structure.

Financially, the company’s net current assets transformed from RMB 800 million at the end of 2024 to net current liabilities of RMB 9.548 billion by mid-2025, primarily due to the reclassification of redeemed liabilities. Following the global offering, these liabilities will be converted into equity, potentially improving the capital structure. Despite high cash burn, the proceeds from the IPO are expected to support R&D and operational needs for the coming years.

Pre- and Post-IPO Equity Structure of Biren Technology

Prior to listing, Biren Technology’s equity was relatively concentrated. A single largest shareholder group comprising founder Wen Zhang and its affiliated entities jointly controlled the company through a concerted action agreement and voting proxy arrangements, holding approximately 17.73% of shares.

Concurrently, Biren Technology has successfully introduced multiple pre-IPO investors, including QM120 Limited, Hangzhou Unicorn No.1 Investment Management Partnership Enterprise (Limited Partnership), and Champ Earn Limited, providing crucial capital support for its development. Upon completion of the listing, the company will meet the HKEX’s requirement for a minimum public float of 25%. Shares held by existing shareholders (H-shares converted from non-listed shares) will be subject to a one-year lock-up period post-listing to ensure market stability.

Use of Funds from Biren Technology Hong Kong IPO

Following its Hong Kong IPO, Biren Technology plans to allocate the raised funds as follows: 85.0% will be used for R&D of intelligent computing solutions, focusing on next-generation GPGPU hardware development and upgrades/iterations of the BIRENSUPA software platform; 5.0% will be allocated to commercial expansion, including scaling sales and marketing teams, establishing showrooms, and enhancing technical support; 10.0% for working capital and general corporate purposes to supplement daily operational funding.

The Core Business Portfolio and Market Competitiveness of Biren Technology

Biren Technology leverages its fully self-developed GPGPU hardware and BIRENSUPA software platform to deliver comprehensive intelligent computing solutions spanning cloud, edge, and endpoint devices. The company excels in performance optimization, cluster management, and ecosystem compatibility.

Focusing on high-computing-power industries such as AI data centers, telecommunications, and fintech, Biren Technology currently maintains a concentrated customer base and is actively expanding its portfolio of leading clients to optimize its market positioning. Industry data indicates China’s intelligent computing chip market will be highly concentrated in 2024, with the top two manufacturers holding 94.4% market share. As a new entrant, Biren Technology anticipates a market share of approximately 0.2% in 2025. Future growth is expected to benefit from domestic substitution trends, potentially driving sustained share expansion.

Biren Technology’s strengths lie in technological autonomy, hardware-software synergy, and commercialization capabilities. Its comprehensive GPGPU architecture delivers high performance, energy efficiency, and scalability, while deep integration of hardware and software forms an elastic technology ecosystem. Commercially, Biren Technology has established partnerships with multiple industry leaders and accumulated over 1,000 invention patents (100% authorization rate). The founder’s dual expertise in AI and semiconductors supports strategic and resource integration, collectively building the company’s differentiated competitiveness in the intelligent computing market.

Key Challenges and Risks of Biren Technology

The intelligent computing chip industry features extremely high barriers to entry, with technology, ecosystem, customer base, and resources constituting the primary obstacles. Biren Technology faces multiple challenges: First, high R&D expenditures have led to persistent losses, necessitating reliance on external financing. Second, its supply chain is impacted by the U.S. Entity List, and the long-term stability of domestic alternatives remains uncertain. Third, intense market competition places the company in a catch-up position regarding ecosystem development and market share. Additionally, concentrated customer exposure and unstable product pricing contribute to significant gross margin volatility, pressuring Biren’s short-term profitability.

Biren Technology’s Strategic Planning Following the IPO

Biren Technology’s strategy revolves around three core pillars: continuous hardware and software technology upgrades, building an open ecosystem, and deepening commercialization in high-computing-power industries. The company will develop next-generation GPGPU chips, optimize the BIRENSUPA software platform, and focus on key industries such as AI data centers, telecommunications, and fintech. By collaborating with clients and industry chain partners, it aims to create a closed-loop “algorithm-chip-application” ecosystem to drive product iteration and large-scale deployment. Simultaneously, it will continue recruiting top-tier R&D talent and provide full-stack intelligent computing solutions to solidify its competitive edge in China’s AI computing power sector.

Biren Technology is pursuing a Hong Kong IPO leveraging its full-stack self-developed capabilities. Should the fundraising succeed, it will support the company’s sustained R&D investments and expansion in the fiercely competitive AI computing power market, positioning it for breakthroughs and growth in this sector.